Cost sharing is a core principle of the Emergency Animal Disease Response Agreement (EADRA). It ensures that the financial burden of responding to an emergency animal disease (EAD) outbreak is distributed fairly between the affected governments and industries. This page explains how cost sharing works, outlines eligible expenses, and describes how contributions are calculated.

What is cost sharing?

Cost sharing refers to the proportional funding of eligible response costs by government and industry parties. The goal is to ensure that those who benefit from the eradication or containment of a disease contribute equitably to the cost of the response.

How cost sharing is triggered

Cost sharing is activated when the National Management Group (NMG) approves an Emergency Animal Disease Response Plan (EADRP). The plan must:

- be developed by the affected state or territory

- be endorsed by the Consultative Committee on Emergency Animal Diseases (CCEAD)

- clearly identify what activities will be delivered under the plan and the associated expenses that the state or territory is seeking to cost share

What expenses can be cost-shared?

Eligible expenses include:

- salaries and wages for additional staff directly involved in the response or backfilling essential roles, and overtime for existing staff working in the response

- operating expenses such as laboratory testing, logistics, and field operations

- essential equipment required for the immediate needs of the response

- compensation for livestock or property destroyed or lost due to the disease, as defined under jurisdictional legislation

Note: capital costs (e.g. vehicles, buildings) and business-as-usual expenses are not eligible.

What expenses are excluded?

Ineligible expenses include:

- Normal commitments: routine activities and resources that underpin a party’s baseline capability to detect and respond to EADs

- Consequential loss: indirect losses such as lost income, market access, or contract breaches

- Recovery costs: post-response recovery and business continuity expenses

For more details, see Consequential loss.

How are costs shared?

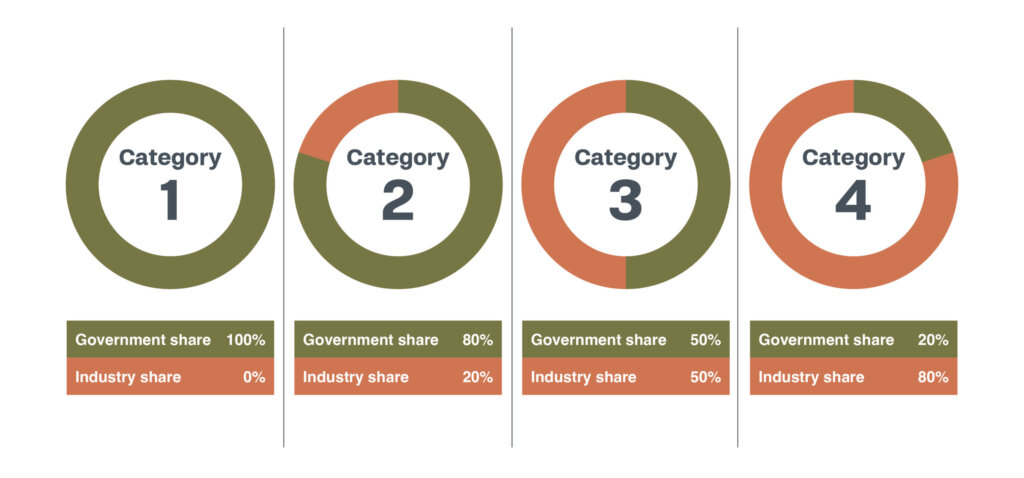

Cost-sharing proportions between government and the affected industry or industries are based on the disease category.

An expert panel determines the specific category of a disease, reflecting the extent to which it impacts the livestock industries versus wider beneficiaries through its effects on trade, livestock production, public health, community amenity, and the environment.

How are contributions for individual governments or industries calculated?

- Industry share: based on the Gross Value of Production (GVP) of the affected industries or as agreed among them.

- Government share: split 50% by the Commonwealth and 50% split between state and territory governments, based on the proportional shares of livestock populations and industry value.

How does industry meet its obligations?

Industries may:

- establish an EAD response levy (usually set to zero and activated only during a response), or

- establish a voluntary levy (so funds are set aside ahead of an outbreak), and

- request that the Commonwealth underwrite their share, with repayment of interest equivalent to the annual inflation rate over time (up to 10 years).

Each industry party must take reasonable steps to ensure it can meet its cost-sharing obligations.

What is the ‘Agreed Limit’?

The Agreed Limit is a cap on the total amount that affected signatories must collectively contribute to fund a cost-shared response under the EADRA. It is typically set at

- 1% of the GVP of the affected industry (or 2% for foot-and-mouth disease)

The limit is a trigger, and if response costs may exceed the limit, the NMG must review the situation and decide whether to:

- increase the limit for the current response

- modify the response

- cease the response or transition to long-term control outside the EADRA